Veteran analyst Louis Navellier claims there’s a massive market rupture on the horizon, with a key technology leading the charge. Do his findings carry any merit? I investigate in my review of Louis Navellier stock picks for the AI proliferation boom.

Louis Navellier is a renowned investor with over 40 years under his belt.

During his lengthy career, he’s established an enviable track record among the four services he leads.

His top-tier Growth Investor platform, birthed in 1998, has resoundingly defeated the S&P 500 by a margin of 3-to-1 over that span.

More than 60,000 readers now tune in to follow Navellier’s growth stock ideas, looking for a piece of that success to call their own1.

Louis has also been called the “King of Quants”, developing a number of simple yet effective tools to lead himself and his readers to these unparalleled gains.

As a money manager, the guru and his team of analysts safeguard nearly $1 billion in funds through his company, Navellier & Associates.

>> Get Navellier’s latest research and insights <<

It’s clear from his past performance that Louis Navellier is more than just smoke and mirrors.

He warned folks about the 1987 crash, the 2000 dot-com crash, and 2008’s financial crisis, helping them to avoid monstrous losses.

The guru recommended Microsoft when it was just 38 cents, also pointing followers to significant gains with Apple stock, Oracle, and many more.

I often see Navellier on Fox Business News and CNBC, and his work frequently appears in The Wall Street Journal, Bloomberg, and MarketWatch.

If that wasn’t enough, Louis travels the country to share insights and seminars and authored one of the best investing books back in 2007.

The $1 Trillion Wake-up Call

Many people right now feel like the world’s completely coming unglued.

There are countless issues to contend with, from inflation to political turmoil and all the chaos that ensues.

To make matters worse, we recently witnessed a stock market shocker with the implementation of China’s DeepSeek that removed more than $1 trillion in market value overnight.

Concerns naturally arose about America’s tech dominance and how such an event could happen in the first place.

In the midst of it all, I began to wonder what these winds of change mean for my money and future.

Luckily, long-time investor Louis Navellier went behind the scenes to connect the dots on this massive shift and how there may actually be a silver lining.

What does the guru know that we don’t?

I haven’t even been alive for as long as Louis Navellier’s been laying out investment strategies that have seen some impressive gains over the years.

His biggest secret to success is a proprietary system designed over the last four decades that looks under the hood of companies and locates trends we often overlook.

By focusing on a venture’s fundamentals and institutional money flow, he’s able to detect profitable patterns that can lead to stock price rises.

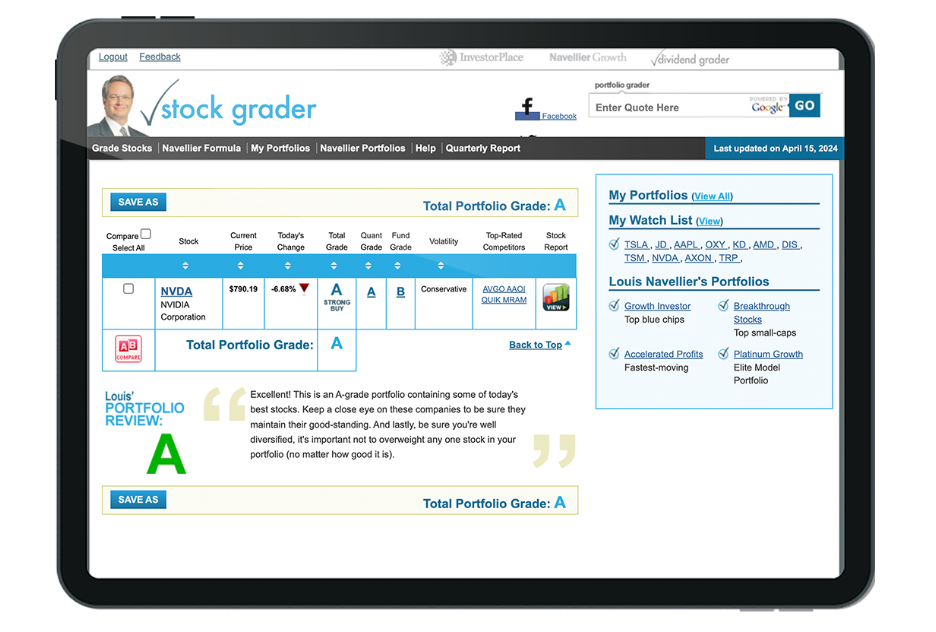

The system scans more than 6,000 securities, handing out stock ratings from A to F, just as you’d see on a report card.

Simply put, Louis Navellier’s stock picks with an A or B rating have strong fundamentals and may be worth checking out, while anything D or below has weak performance indicators.

Having software like this at my fingertips already sounds like a win, but what’s this stock grader picking up right now that has Navellier so excited in the first place?

>> Access Navellier’s power-packed system <<

The Artificial Intelligence Catalyst

Looking at the stock market at a glance, as I often do, you wouldn’t blame me for not connecting the dots on big gains from companies like GoDaddy, Sweetgreen, and Abercrombie in 2024.

Past performance would indicate these businesses should be going nowhere, but it’s actually AI that turned them into breakthrough stocks.

Unassuming as they are, each of these enterprises put artificial intelligence to work in ways that led to profits and, therefore, the earnings growth they enjoyed last year.

Those companies may be old news now, but Navellier believes we’re just at the beginning of an AI rupture that will push many others into the spotlight.

AI is looking to be the next big catalyst to elevate early adopters to new levels and send stock prices up with them.

Even more exciting is that artificial intelligence spans just about every sector of the market, meaning we can see these monumental gains from just about anywhere.

We just need to be ready to capitalize on them.

How to Play the AI Boom for Profit

In case you’re not sold on the AI craze, think of the companies that passed on the internet some 20 years ago (Blockbuster, anyone?).

If you missed out on companies like Apple, Amazon, and Netflix that rode the internet to towering heights, all hope is not lost.

Louis predicts the AI proliferation boom is just getting started, and firms taking advantage now are the ones set to have the biggest gains.

Navellier’s logic makes perfect sense, and the way AI is expanding could make the internet boom pale in comparison.

My issue is knowing precisely where to invest, which is where our guru comes in.

You can get instant access to all of Louis Navellier’s stock picks for the AI boom by signing up under his latest deal.

Let’s check out everything that comes with a subscription.

>> Unlock Louis’ top picks now! <<

What’s Included With The Subscription?

Here’s everything you’ll receive for becoming a Growth Investor member:

One Full Year of Growth Investor

Signing up unlocks a full year of Growth Investor newsletter, where you’ll receive at least one of Louis Navellier’s stock picks every month.

In addition to recommendations, Louis also shares the top investment strategies he’s currently pursuing and how trends bubbling to the surface could impact the stock market.

For someone who’s been on the scene for nearly five decades, Navellier takes a surprisingly down-to-earth approach to his writing.

I appreciate him cutting through meaningless jargon to evaluate stocks and provide investment philosophy in a clear and concise manner.

With a focus on growth stocks, Louis is able to pull from just about any sector without compromising the goal of his service.

Growth Investor Model Portfolio

Every stock that appears in Growth Investor makes its way into the service’s model portfolio that members can access at any time.

The model portfolio is an excellent place to evaluate stocks Navellier currently has as a buy and see how they’ve been performing since they first made the list.

This was one of the first places I visited after reading through the bonus reports to glean a few more suggestions I didn’t already have on my radar.

It speaks volumes to me that Louis keeps all his recommendations on display here, including those that don’t turn out as planned.

No one can be right 100% of the time, and I’m always leery of platforms that hide their losses.

Podcasts And Flash Alerts

Whenever urgent market news breaks, Navellier is quick to send out a podcast that explains the events unfolding in as close to real-time as possible.

The same holds true if it comes time to collect profits on one of the active positions in his portfolio, so you’re not left in a lurch.

These typically come directly to your inbox, and you’ll want to watch for them so you don’t miss your shot at returns.

Weekly Portfolio Updates

Unlike most services I’ve seen, Louis also sends out weekly portfolio updates recapping each Growth Investor pick and what you should do with them if they’re in your own portfolio.

It comes out on Fridays, giving you a full review of the past week and a look ahead at what’s to come.

All you have to do is pop into your inbox and give it a quick read to feel up to speed on all the market’s shifting trends.

Most issues even come with the top stocks Navellier is excited about and why he’s feeling bullish on them for the week.

One Year of TradeStops Basic

New Growth Investor members also receive a complimentary year of TradeStops Basic to play with.

This tracking tool helps keep an eye on each of your newsletter positions so you have peace of mind about how they’re doing.

It also takes a lot of the emotion out of trading, helping you decide when it’s time to exit without all the stress.

With a few keystrokes, you can sync your portfolio with a brokerage account for real-time tracking, calculate ideal position sizes, and use the tool’s exclusive volatility quotient to set clear investment goals.

While you are only getting a basic membership here, I had no issue saving the $299 and getting a free 12-month introduction to just what this software can do.

>> Try Tradestops Basic now! <<

Customer Support

If you’ve read my other reviews, you know how much I hate auto assistants when I call with questions or to make changes to my account.

Growth Investor removes that problem by giving members a direct phone line to their customer service team.

These folks can’t offer investment advice but are well-versed in answering questions about the platform and issues you may have.

The time you save calling in is such a lifesaver given how busy we all are, and I’m almost afraid what will happen the next time I call into a company without such a perk.

Research Bonuses

You’ll also get your hands on each of these bonus materials by signing up right now:

12 “Must Own” Stocks for AI’s Proliferation Boom

This must-have special report contains all of Navellier’s favorite opportunities stemming from the upcoming AI boom.

He shares the names and ticker symbols from 12 unique companies embracing AI in incredible ways, explaining in detail why each one has wealth-building potential.

Each stock pick is given a strong ratings by Navellier’s system, too, which builds my confidence in them even more.

Louis doesn’t stop there, explaining much of the science behind the AI proliferation boom and how he feels it will play out.

I enjoyed how he even gives a timeline of when the trend could peak so I can maximize my chances at success.

>> Get immediate access to all these features and more here <<

11 “Must Sell” Stocks for AI’s Proliferation Phase

For every company that will rise as part of the artificial intelligence shockwave, many more will fall by the wayside.

Knowing which stocks to avoid helps clear your portfolio from devastating losses set to erase any earnings from the boom’s biggest winners.

These bottom-rated stocks all received low ratings from Louis Navellier’s system, and you’ll get their names and ticker symbols right in this handy guide.

I was honestly surprised by some of the names in here, and some of them are still considered worthwhile investments elsewhere.

You can decide what to do with these names after you’ve read this report, but Louis offers compelling reasons for jettisoning each one.

>> Get all these research bonuses in your inbox now! <<

FREE 24/7 Access to Stock Grader

One of my favorite parts about this stock-picking service is that Louis does way more than tell you which opportunities to invest in.

He actually hands you the keys to his proprietary Stock Grader, so you have unrestricted access to his powerful system.

It’s super easy to use, too. You simply type in one of more than 6,000 tickers, and the software spits out a grade from A to F.

You should still do your own research, as no tool is perfect. But this tool has been instrumental in firming up a decision on buying a stock or removing something from my portfolio.

Best of all, you can use it any time as long as you’re a Growth Investor member.

90-Day Money-back Guarantee

You’re handed a very generous 90 days to test out everything Growth Investor has to offer before making a final decision on whether the service is for you.

This means you can play with the Stock Grader, read multiple newsletter issues, and enjoy the bonus reports before making any sort of commitment.

If there’s anything you don’t like during that initial window, simply reach out to the customer support team for a full refund of your membership fee.

You’ll even get to keep all the materials you’ve collected up to that point as a thank-you for giving Growth Investor a go.

Since most services only provide 30-day refund policies, having this extra time to gauge my interest was a breath of fresh air.

>> Join risk-free under 90-day moneyback guarantee <<

How Much Is It?

It usually costs $499 for a full year of Growth Investor and all the content therein.

Right now, as part of this special deal, you can snag it all for just $99. That’s 80% off the sticker price!

At the end of the day, you’re paying just over $8 per month for investment strategies, key insights, and at least one new stock pick you can take action on.

Even better, you can renew your subscription for the same low $99 rate you lock in when you sign up for the first time.

I’ve explored every inch of Louis Navellier’s Growth Investor service, and I’d rate it right up there with the best of them.

For starters, it’s always hard to top a guru of his caliber, and there are few people I’d rather listen to.

On top of that, you’re rewarded with tons of excellent content from the Growth Investor newsletter and bonus reports to take advantage of right out of the gate.

Being able to receive stock grades from Louis’ proprietary rating system is a huge perk you can use beyond even what this service offers to vet your own research.

Any one of these features on its own is worth the price of admission, but you get them all right now for just $99.

Let’s not forget the 90-day money-back guarantee that allows you to dip your toe in the water before diving fully in.

There’s a lot to like here, and I highly recommend signing up if you’re on the hunt for conservative stocks backed by quantitative analysis.

>> Claim your 80% discount BEFORE IT’S GONE!! <<

Backed in AI Appliers copy

Tags:

Tags: