Dan Ferris claims that portfolios could be swept away as America falls into the mysterious “Dead Zone”. But is his analysis spot on, or is he off the mark? Check out this Ferris Report review to find out.

What Is The Ferris Report?

The Ferris Report is an investment newsletter helmed by Dan Ferris and published by Stansberry Research.

Members receive monthly recommendations, bonus reports, market commentary, and other perks. The recommendations focus on stocks and exchange-traded funds.

His recommendations dial in on durable companies that could capitalize on macro and micro trends, with typical holding periods for positions ranging anywhere from years to even decades.

In terms of strategy, Dan’s core focus is helping prepare portfolios in the event that an economic downturn takes place. Many of his past predictions have come to pass, saving his readers tons of money in the process.

The Ferris Report team could also occasionally recommend investment strategies that are more off the beaten path to break up a more monotonous portfolio.

You’re of course welcome to pursue these as you see fit, but these trade ideas are designed to complement his other approaches.

>> Sign up NOW and SAVE 74% <<

Who Is Dan Ferris?

Dan Ferris is an investment analyst who does a great job of cueing members into under-the-radar stock market moves.

As a value investor, he aims to find “some of the lowest-risk and yet most profitable stocks in the market: great businesses trading at steep discounts.”

Just launched in 2022, The Ferris Report is a relatively new addition to the Stansberry Research lineup considering that Dan himself has been a core member of the team since 2000 and has published his other newsletter, Extreme Value, since 2002.

(Extreme Value, by the way, has locked in a rock-solid 4.1 rating on Stock Gumshoe1.

Keep in mind that this is a third-party site, so I cannot verify the veracity of these ratings. Still, it’s a good sign that Dan Ferris has received such high praise.)

>> Access Dan’s top picks and recommendations now! <<

Is Dan Ferris Legit?

Over the decades, his cautious approach to finding undervalued stocks with solid upside potential has earned him a loyal following.

He has also made some impressive calls, which have provided his readers the opportunity to capture double- and triple-digit winners.

While his previous picks are impressive, it’s important to note that these results are not typical, and past performance is not an indicator of future results.

In addition to his widely popular newsletters, Dan Ferris also hosts the Stansberry Investor Hour podcast, where he regularly shares his insights on the market.

Dan has also appeared in several prominent publications, including Money with Melissa Francis2, Fox Business’s The Willis Report, and Paul Bagnell’s The Street3.

Dan Ferris’s “The Dead Zone” Presentation

Living in the United States feels more uncertain than ever.

There’s such a rift in ideology that some envision a divorce of sorts or even a civil war on the horizon.

Others face new fears about safety and security as crime moves toward new highs.

People are more nervous than ever about making ends meet as wages just don’t seem to equate to the rising cost of living.

Despite all of that, Dan believes another event is coming that will radically change our country’s landscape.

It has the potential to severely cut market indexes and send those of us working toward retirement into a never-ending tailspin.

He calls it the “dead zone”. My question is, is there anything we can do to prepare for it?

>> Get the full scoop on Dan’s dead zone presentation <<

What Is the “Dead Zone”?

To understand the “dead zone”, I have to first take you back to 1980s Japan.

It was the wealthiest country in the world at the time, with stocks soaring high4.

All that changed when the broader market crashed by over 60% and took more than 34 years to recover – the dead zone5.

As much as I love Japanese culture, it’s thousands of miles away. Those same problems couldn’t end up here, right?

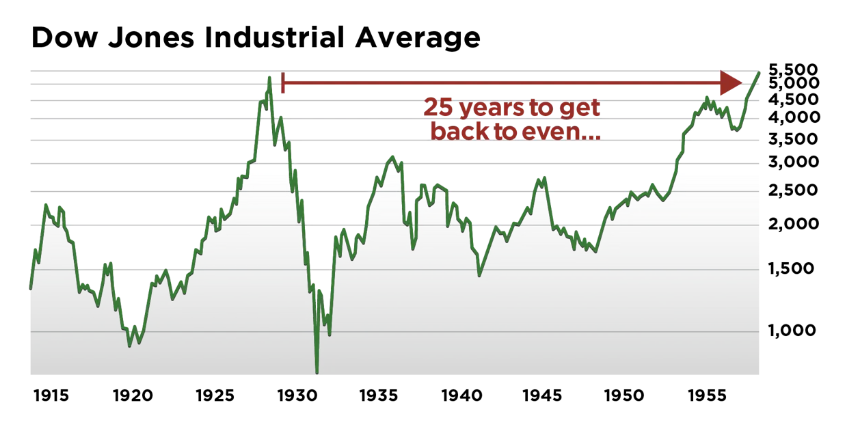

Dan draws our attention to not only the Great Depression but also America’s dead zone of the 1960s6. Each took over 25 years to bounce back from.

Here’s the thing – the stock market did eventually climb back to previous highs, but DECADES after the initial fall.

I’m not sure about you, but I can’t afford to wait 25 years for my long-term investments to make a recovery.

The Writing’s On The Wall

As crazy as this all sounds, Dan teases that we’ve been experiencing warning signs for the last 15 years.

President Obama warned about the government’s course during 2008’s recession7, but it sure doesn’t look like anyone listened.

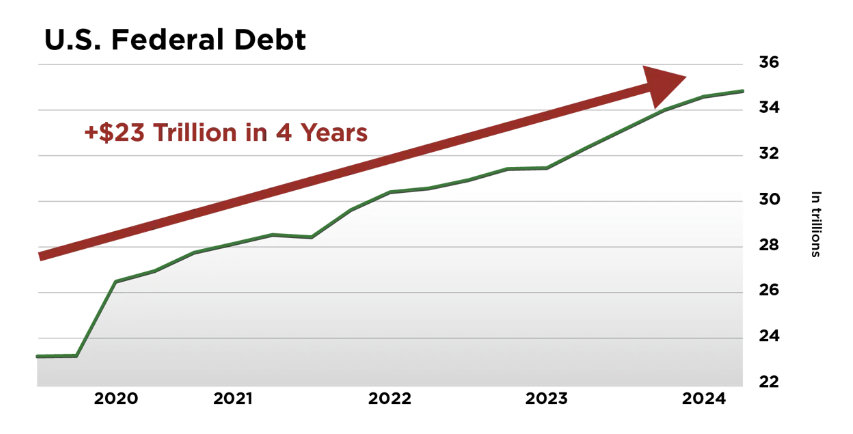

We just keep kicking our debt down the road, which led to a borrowing binge that flooded the economy with cash.

Out of that came a debt-fueled bull market that we’re still sitting in now, secretly boiling under the surface.

Ferris even points out that Federal debt is up some $23 trillion in the last four years alone8, and there’s no longer any means to pay it off.

What scares me is that not even the Fed can save the economy with that much crippling debt on their shoulders.

If this mega bubble pops, no one’s coming to save us this time around.

How to Survive the Dead Zone

If Dan’s right, it’s entirely up to you to survive the upcoming dead zone.

The story’s not all gloom and doom, though – there’s opportunity in every crisis, and that applies here too.

However, now’s the time to prepare should the worst-case scenario come to pass. Once we’re knee deep in it, it’s too late to take action.

There are still certain investments to make and stocks to clean out of your portfolio before the crap hits the fan, but you’ve got to know which moves to make.

Fortunately, Dan’s already taken the time to research the situation and uncover the best plays to make.

You can have instant access to his recommendations and a whole lot more by signing up for The Ferris Report under Dan’s new deal.

Join me as I unpack everything that comes with a membership.

>> Unlock Dan Ferris’ top picks now! <<

The Ferris Report Review: What Comes with the Service?

Dan’s deal for his latest presentation includes access to his latest research and other perks.

Annual Subscription to The Ferris Report

Each month, Dan shares his knowledge with the masses through The Ferris Report newsletter. Inside, you’ll hear about his most recent investing insights and where he feels you should be putting your money.

The newsletter provides members with recommendations that are heavily vetted by the team. It’s typically a stock or ETF, but inverse ETFs could make an appearance as well.

Something I appreciate is that there’s no deliberate rotation between stock and ETF picks. The team isn’t putting an investment idea on ice to fill a quota.

The Ferris Report also provides much more than the ticker. It offers supporting research, market commentary, warnings, and more. The analysis also includes a look into the latest micro and macro trends.

Best of all, you’ve got Stansberry’s longest-tenured analyst helping you through a challenging time for making money on the markets.

>> Join NOW and SAVE 74% off <<

The Ferris Report Model Portfolio

Members have access to the model portfolio, where all the service’s open positions are logged. This handy resource shows new picks the moment they’re recommended.

Each pick contains:

- The ticker, ref date, and ref price

- Dividends

- Recent and buy-up-to price (if there is one)

- Returns and more

You get a front-row seat to the effectiveness of Dan’s investment strategy. Whether a ticker wins or loses, it’s there for subscribers to see.

Model portfolios are fairly standard in the industry, but The Dan Ferris Report offers some unique features.

By clicking on a stock ticker, members are welcomed with a stock chart. This screen also offers two options to check the Stansberry Company Score or initial recommendation.

Special Alerts and Updates

Big gains and catastrophic tumbles rarely follow a set schedule, so Dan goes above and beyond to ensure his subscribers stay in the loop with updates and alerts.

Dan’s alerts cover a wide range of subject matter, including emerging opportunities, breaking news, upgrades & downgrades for model portfolio stocks, and much more.

Every alert goes to your email inbox, so you can easily access them from all your devices, including your mobile phone.

Dan’s alerts are a great remedy for stock market anxiety. During my time test-driving the service, I found myself checking the market much less frequently because I knew Dan would alert me if something big needed my attention.

Research Archives

The reports featured in this bundle are only the latest examples of Dan’s in-depth stock market research efforts.

Over the years, he’s published dozens of informative write-ups and research reports for Ferris Report members, and you can access them all as soon as you join.

Every new report that comes out is immediately entered into the archives, so active members will have instant access to them as soon as they’re published.

Exploring Dan Ferris’s archives led me down a seemingly endless rabbit hole of stock market content. Some of the reports are dated, but there are still a lot of valuable insights to tap into here.

Stansberry Investor Hour

A new episode of Stansberry Investor Hour airs each Monday. In the podcast, Dan Ferris delivers top-tier insights and interviews some of the brightest minds in business, investing, and politics.

Thanks to the variety of guests, you’ll get unfiltered feedback from multiple angles on some of the most pressing market issues.

>> Get exclusive access to Dan’s latest insights <<

The Stansberry Digest

This daily newsletter is delivered to members every weekday after the market closes. It’s a good read for someone interested in daily market commentary with diverse angles.

In addition to Dan’s contributions every Friday, this e-letter also offers insights from some of Stansberry Research’s other analysts.

Stansberry Digest‘s daily, news-focused content is an excellent complement to the monthly newsletter. It doesn’t include stock picks, but it will keep you informed on all the latest stock market happenings.

One Full Year of Dan’s Warnings and Predictions

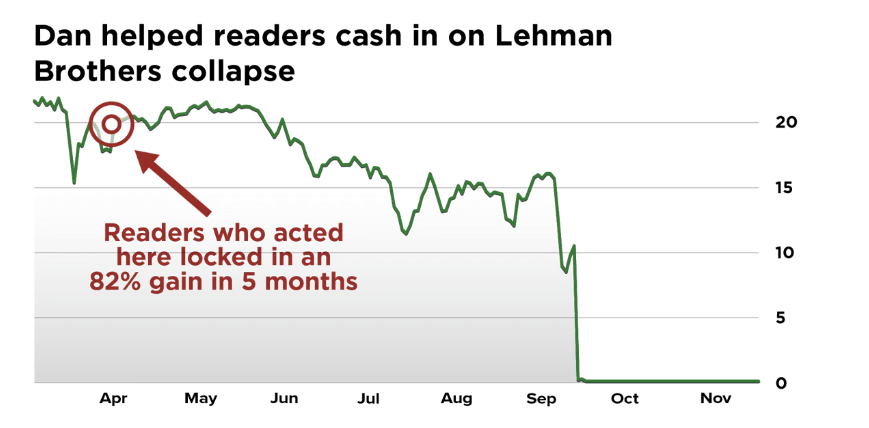

Dan’s well-known for his uncanny ability to see huge upward swings or disasters before they happen.

He successfully predicted the collapse of Lehman Brothers in 2008, Bitcoin’s huge downturn in 2018, and when Nasdaq hit incredible highs in 20219.

This foresight could have saved savvy readers tons of money or even brought in significant new wealth, and that’s just scratching the surface of what the guru’s been able to do.

As part of a The Ferris Report subscription, Dan will keep you informed of potential opportunities or threats to your finances that you – and even Wall Street – will likely never see coming.

>> Access all these features and more for 74% OFF <<

“Dead Zone” Special Reports

You’ll also get several bonuses with your Ferris Report subscription that focus on Dan’s “Dead Zone” presentation. Follow along for a breakdown of each resource.

How to Escape America’s Lost Decade

In this special report, Dan Ferris shares how to sidestep the crash and “lost decade” of sideways trading and false rallies set to follow.

His solution involves moving your money away from the major U.S. stock indexes that could be locked in a dead zone for upwards of 20 years.

Instead of commodities like gold or bitcoin, Dan explains the perks of a special type of “escape” asset designed to generate positive returns no matter the economic climate10.

It’s not some secret foreign asset, either. You can actually invest in it directly from your brokerage account.

A quick read will give you the name, ticker, and every detail you need to know about adding this opportunity to your portfolio.

800% Long-Term Gains – Even in a Terrible Bear Market

During Japan’s 34-year economic struggle following its stock market crash, most stocks resulted in 0% capital gains at best. Not the number I’d ever want to see after decades of investing.

After the fact, studies indicated a rather unknown investment vehicle that defied the above pattern.

In fact, moving money there could have returned as much as 1,667% profits when most other securities were dead weight11.

Whether this crash comes to America or not, this same opportunity is available here. It’s not some high-risk investment like options, microcaps, or the like.

Apparently, it’s not an easy vehicle to master. I’ve never dabbled with it, and knowing where and when to buy is no picnic.

That’s where Dan Ferris comes in. This guide explains the asset in detail and how you can get involved for a chance at those same types of returns.

The Recession Haven That Could 7x Your Money in 10 Years

We may see several big-name stocks crumble during an economic meltdown of this nature.

However, there’s one investment Danbelieves is perfect for keeping your money in the stock market with less risk, even if more than just the wheels come off.

The logic behind Dan’s assessment makes perfect sense – this sector is intricately tied to the U.S. government.

That said, it actually has nothing to do with the current banking system or the auto industry. Getting in right now creates your longest runway for potential gains.

Since the Fed began slashing rates in the 1980s, this “escape” asset has surged as much as 999 times—enough to turn $10,000 into nearly $10 million.

You’ll get the full scoop in this special report so you can position yourself for the biggest potential profits.

>> Get instant access to all special reports <<

Avoid at All Costs: These Stocks Will Never Trade This High Again in Your Lifetime

Dead zone or not, Dan’s been tracking companies he feels are the most dangerous investments in America today.

He’s listed his top 12 in this special report, along with a detailed explanation of why each one is in such bad shape.

Offering more than just a current snapshot, Dan also shares which investment sectors you should avoid both inside and outside of the stock market that many Americans own.

Before you finish reading, you’ll know how to scour your retirement accounts for these detrimental stock picks to minimize your risk.

I wasn’t thrilled to see some of these names, but Dan’s reasons for getting out were very compelling.

30-Day Money-Back Guarantee

New memberships to The Ferris Report come with a 30-day money-back guarantee.

This means you can take the service for a test spin for about a month. If you decide it’s not a good match, you can request your money back for the price of the subscription.

Thirty days is our industry standard, so the service lines up with many of its competitors.

Recommendations typically lean into the long term, so this might not be enough time to see a position to its conclusion.

However, it gives you enough time to experience a full monthly cycle of the service, so you’ll be able to get a good idea of what you’re getting into.

Thirty days is a standard but solid guarantee. Plus, Dan is offering a cash-back refund if you’re unsatisfied.

Although I would prefer a longer term, the Ferris Report guarantee is enough to ensure you won’t be dissatisfied with the service.

>> Sign up risk-free under Dan’s guarantee <<

Dan Ferris Stock Picking Performance

A guru is ultimately only as good as his stock picks. If they can’t show you how to earn money by calling out good investments, what’s the point in picking up their service?

Let’s take a look at how some of Dan’s recent selections from across his services have fared on the market.

VanEck Gold Miners ETF (NYSEARCA: GDX)

Dan first recommended VanEck’s Gold Miners ETF at the tail end of 2022. Predicting that gold would be on the rise, he opted for a fund covering a swath of companies involved in gold mining.

ETFs aren’t typically big movers or shakers, but GDX has done quite well so far this year. That’s despite a two-month downturn from January to March.

At present, GDX is up 17% from its initial buy price, and Dan still has it on his list to purchase. While you ride the wave to the top, don’t forget the $0.48 dividend the ETF regularly pays out to shareholders.

Sturm Ruger & Company Inc (NYSE: RGR)

Another of Dan’s big favorites right now is Sturm Ruger. Founded in 1949, it’s one of the leading producers of American firearms.

I’m not exactly sure of Dan’s fascination with RGR since most of his top tickers involve gold or silver. He’s clearly onto something here, though.

The day after Dan recommended buying RGR stock in late November, it shot up close to $6. Although the stock did drop right at the end of the year, it’s been on a steady rise ever since.

Dan Ferris believes it will continue to rise until about the $64 mark, where his advice is to jump ship. Share prices are up 15% from his buy date, but there’s still plenty of time to get a piece of this pie.

RGR also pays out a healthy $5.42 dividend.

ExxonMobil Corp (NYSE: XOM)

One of Dan’s newest suggestions is oil giant ExxonMobil. He added it to his list at the end of January with a buy recommendation of up to $1172.

For the most part, XOM has seen gradual upward momentum this year, climbing from $113.81 to nearly $117 at the end of April. It was only as May reared its head that the stock plummeted to unsavory lows.

XOM has been a great selection up to this point. ExxonMobil has done well the last few years, but it will be interesting to see what Dan does with this ticker moving forward.

The company hands out $0.91 in dividends, so even a setback isn’t all gloom and doom.

Sprott Inc (NYSE: SII)

Looking back a bit further, Dan was all about Sprott stock. This asset manager provides more than a quarter million clients with access to precious metals around the world.

He first called out Sprott in February 2021, right at the start of an upward swing. It jumped through several iterations of ups and downs but even today sits higher than where it was two years ago.

Considering 2022 was a rough year for the stock market as a whole, it’s a surprise to see any stock maintaining course or actually pulling ahead. Folks taking advantage of those spikes could have come out the other side with a few extra bucks in their pocket.

Dan Ferris also enjoyed the royalties that Sprott brings. It was paying out about 3% to faithful shareholders.

>> Unlock Dan’s latest predictions <<

Pros and Cons

The Ferris Report is a solid newsletter, but there are a few downsides to the service.

Pros

- Affordably priced with a substantial 74% discount

- 30-day money-back guarantee

- Features four bonus research reports

- New stock picks almost every month

- Backed by leading publisher

- Led by top-tier guru Dan Ferris

Cons

- No investment community forums or chats

- Does not cover shorts or options

Is The Ferris Report Right for Me?

The Ferris Report has a lot to offer, and its balanced approach appeals to a wide segment of its audience.

Dan’s research strikes an ideal middle ground between risk and reward, and it’s an excellent resource for nearly anyone looking to get more out of the market, regardless of their strategic focus.

The subscription comes at a price that is accessible for most stock market beginners, and it will give you access to a monthly stream of new Dan Ferris stock research for an entire year.

If you’re the type of person who is too busy to scour the scanners for promising stocks, The Ferris Report could be a great match.

It allows you to focus your attention on Dan’s high-quality stock picks instead of squandering endless hours chasing dead ends on Finviz.

However, if you’re primarily interested in day trading,this subscription may not be suitable for you. One pick per month will probably not satisfy the high-frequency research required by day traders.

>> Save 74% when you join now! <<

How Much Is The Ferris Report?

A one-year subscription to The Ferris Report typically costs $499, but you can take advantage of a big discount under the current deal.

For a limited time, you can save 74% off the sticker price and get started for just $129. You’ll get the entire research bundle for that price, including the money-back guarantee and special reports.

That rate jumps to $199 if you decide to renew your subscription, but this price point is still quite a bit lower than the typical fee for becoming a member.

Is The Ferris Report Worth It?

The Ferris Report is a great service that’s well worth the price of admission. For a little over $10 a month, you can tap into analysis from one of Stansberry Research’s brightest minds.

The package is stacked with valuable resources, including four special reports containing research that could help you survive and thrive during the next economic downturn.

With daily market news and as-needed updates, The Ferris Report has everything you’ll want to conveniently stay informed.

Plus, it’s all backed by a 30-day money-back guarantee, a respected publisher, and a prestigious guru in Dan Ferris.

After a thorough Ferris Report review, I can honestly say this is a top-notch service that lives up to Dan’s reputation. I recommend checking it out if you’re looking for an extra edge in the stock market.

>> Claim your 74% discount HERE <<

Footnotes

- https://www.stockgumshoe.com/reviews/extreme-value/

- https://www.youtube.com/watch?v=6ZFsF9bfR1g

- https://marketwise.atlassian.net/wiki/spaces/SLD/pages/72568242195/Dan+Ferris+Media+Appearances

- https://www.latimes.com/archives/la-xpm-1989-08-21-fi-806-story.html – “Japan Surpasses U.S. in Asse…

- https://vladimirribakov.com/history-japanese-financial-crisis/ – Japan’s stock market fell 63% initi…

- https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart From the promo: “That’s 30 year…

- https://www.wsj.com/articles/SB123419281562063867?mod=djemalertNEWS

- https://fred.stlouisfed.org/series/GFDEBTN

- https://marketwise.atlassian.net/wiki/spaces/SLD/pages/71015333939/Dan+Ferris+Predictions

- DBMF… which is a managed futures fund. Here is an article on managed futures: https://www.iasg.com/b…

- https://archives.hkust.edu.hk/dspace/bitstream/9999/41727/1/2013-06-28.pdf

Tags:

Tags: